Group Elite Long Term Disability

Issued by the Prudential Insurance Company of America

One in eight Americans will be disabled for five years or more during their working careers, according to the Council for Disability Awareness. Yet 67% of Americans have no long term disability coverage states the Social Security Administration.

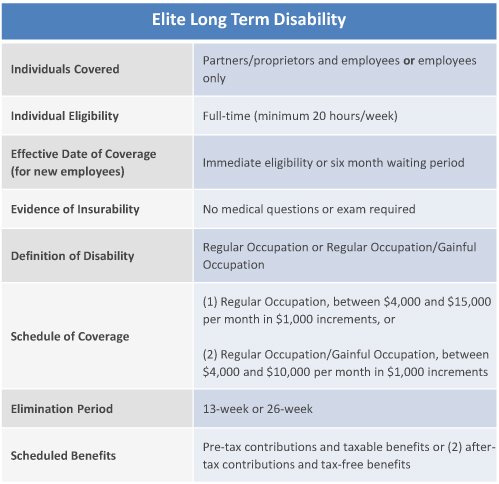

The Group Elite Long Term Disability Plan, endorsed by the AICPA is specifically designed for CPA firms with 25 or more eligible lives to be covered. This Elite Plan allows benefit administrators to control cost through flexible options. Customize your firm's disability benefits by choosing between two definitions of disability, your monthly benefit amount, waiting periods and more.

Firm Eligibility

Your firm is eligible if it has its principal office in any state of the United States except Iowa.

Public accounting firms must have at least 25 eligible lives to become insured; and the proprietor, or at least one partner of the firm or firm member must be a member of the AICPA. In addition, the firm must have at least one eligible full-time employee, other than the proprietor, partner or firm member, who is to become insured on the date participation begins for the firm.

For firms that are not in public accounting, a member of the AICPA must have at least 50% ownership.

COVERAGE DETAILS

The Elite Long Term Disability Plan allows plan administrators to build their own customized disability program from their firm. Choose among the following options:

Definition of Disability

Choose between two definitions of disability:

(1) Regular Occupation is defined as the inability of an insured owner or employee to work at the occupation they were performing at the time of the disability.

(2) For a lesser premium, the firm has the option of selecting the Regular Occupation definition of disability for the first two years of disability and then a Gainful Occupation definition thereafter. Gainful Occupation is defined as the inability to work at any occupation for which the insured is reasonably fitted by education, training or experience and you are under the regular care of a doctor. *

*Gainful occupation means an occupation, including self employment, that is or can be expected to provide you with an income within 12 months of your return to work, that exceeds:

- 60% of your indexed monthly earnings, if you are working; or

- 60% of your monthly earnings, if you are not working.

The amount of monthly disability benefits available depends on the definition of disability selected.

- When selecting the Regular Occupation definition of disability, the firm may elect a maximum monthly coverage amount between $4,000 and $15,000 in $1,000 increments.

- Firms electing the Regular Occupation/Gainful Occupation definition of disability may elect a maximum monthly coverage amount between $4,000 and $10,000 in $1,000 increments.

Elimination Period

13 week or 26 week elimination period

The firm administrator elects whether contributions are deducted pre-tax or after tax and whether benefits are taxable or non-taxable. The firm can select among four options:

(1) Pre-tax contributions and taxable benefits of 60% of pre-disability earnings (100% firm paid),

(2) Pre-tax contributions and taxable benefits of 66 2/3% or pre-disability earnings

(100% firm paid),

(3) After-tax contributions and tax-free benefits of 60% of pre-disability earnings (100% employee paid), or

(4) After-tax contributions and tax-free benefits of 60% of pre-disability earnings (100% firm paid with gross up earnings).

For new hires, benefits may start immediately or after a six month waiting period.

Partial Disability

The Group Elite LTD plan offers coverage for partial disabilities. Partial disability is defined as losing 20% or more of income due to sickness or injury. This means a plan participant could receive benefits when working part time. Eligibility is based on the definition of disability applicable at the time of disability and when the decrease in the insured's earnings was effective.