Group Life Insurance

Issued by the Prudential Insurance Company of America

Now your firm can join approximately 5,000 firms in the Group Insurance Plan endorsed by AICPA. Your employees will get the features they want in a contemporary insurance plan responsive to their needs.

Firm EligibilityYour firm is eligible if it has its principal office in any state of the United States except Texas.

The proprietor or at least one partner or firm member of a public accounting firm must be a member of the AICPA; or for firms other than a public accounting firm, a member or members of the AICPA must have at least 50% ownership.

In addition, the firm must have at least one eligible full-time employee, other than the proprietor, partner or firm member, who is to become insured on the date participation begins for the firm.

Who May be CoveredProprietors, partners or firm members, staff and employees in the firm who work a minimum of 17.5 hours per week and not less than five months in a calendar year.

Medical RequirementEvidence of insurability will be required for firms with less than 25 eligible lives. Typically individuals will be accepted on the basis of their answers to questions on the Medical Statement Form, without further medical evidence being needed.

When Coverage BeginsDepending on the option elected by the firm, insurance may be requested on an immediate basis (starting date) or after completing six months of continuous service. An individual must be actively at work on the day coverage is to begin.

COVERAGE DETAILS

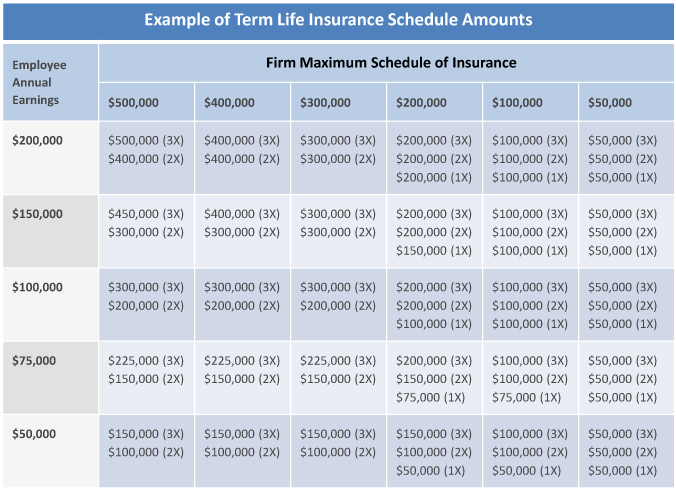

Choice of Six Schedules of Insurance

Your firm can choose from schedules of coverage with insurance maximums of $500,000, $400,000, $300,000, $200,000, $100,000, or $50,000.

Proprietors or partners under age 65 can be covered for the schedule maximum without regard to earnings.

Choose Either Three-, Two-, or One-Time Earnings CoverageEmployee coverage is based on annual earnings. Choose coverage for your firm personnel based on three-, two-, or one-time earnings.

Example of Term Life Insurance Schedule AmountsAn equal amount of Accidental Death & Dismemberment Insurance is included.

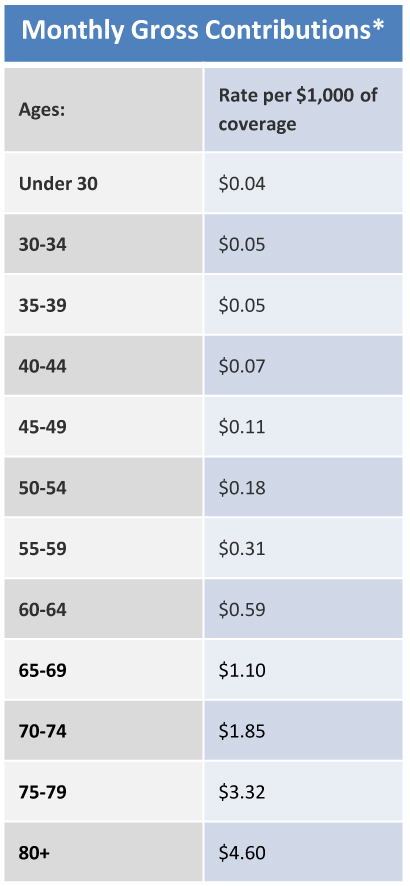

*Monthly gross rates shown here became effective October 1, 2013. Rates may only be changed on a class basis. Coverage includes $1,000 of term life insurance plus $1,000 of accidental death and dismemberment insurance. Rates may only be changed on a class basis. Rates may be re-determined by the Board of Directors of AICPA, but not more often than annually [once per year]. Your rates may increase as you enter higher age bands.

Cash RefundsCash refunds paid by the AICPA Trust, which are paid out of premium refunds received by Prudential, can help lower your firm's costs. While not guaranteed, cash refunds have been paid for over 40 years. What you can count on are low net costs and sound business practices.

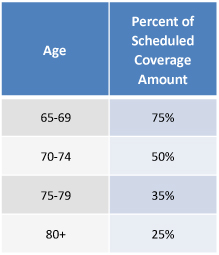

Coverage Amounts for Ages 65 and OverOnce firm employees reach age 65, coverage amounts begin to reduce. The chart below lists the applicable amount of life insurance based on a percentage of their scheduled amount through age 64.

Coverage is based on the earnings basis as elected by the firm, rounded up to the nearest thousand and subject to the schedule maximum. Annual earnings do not include bonus or overtime, or compensation from any other employer. Coverage amount and age as shown on the individual's request for coverage will be used.

ADDITIONAL COVERAGES

Optional Dependent Coverage

Eligible dependents include the spouse and children of those insured under the firm's Plan. The spouse of the insured proprietor, partner, firm member or employee is covered for one-fourth the insured's life insurance amount, up to $25,000 and cannot be on active duty in the armed forces. Each eligible child can be insured for $10,000 from birth until age 25.

Waiver of PremiumIf an insured becomes totally disabled before age 60, life insurance coverage will be extended at no cost while the insured remains totally disabled. As long as the disability continues, and periodic proof of disability is furnished, the death benefit protection will be extended from year to year while the premium is waived. (This extension of coverage does not apply to dependent coverage, nor to the employee's Accidental Death & Dismemberment insurance.)

Accelerated Benefit OptionA no-cost feature of the Plan, the Accelerated Benefit Option allows insureds who become terminally ill to receive a portion of their life insurance coverage amount in a lump sum, generally tax-free. Click here for more information.

Accidental Death & DismembermentIncluded with the term life insurance benefit are Accidental Death & Dismemberment benefits. Under this provision, an additional amount equal to the full amount of the insured's life insurance will be paid in the event of accidental death; loss of both hands, both feet, sight in both eyes, one hand and one foot, one hand and the sight in one eye, or one foot and the sight in one eye. One-half the face amount is payable for the loss of one hand, one foot or the sight in one eye. The accidental death benefit is payable to the named beneficiary. All other accident benefits are paid to the insured, if living, otherwise to his or her estate.

ONLINE ACCOUNT MANAGEMENT TOOL

Self-Service Center

Another great benefit of the Plan is the online self-service center at www.trustmyaccount.cpai.com. From this site you and your firm administrator can:

- Set up and manage your firm's account

- Process annual elections

- View payment history, recent transactions, annual refunds and more!